The budget classification, containing codes of types of expenses, is a grouping of budget indicators at all levels of income and expenditure, as well as all sources of financing that are used to cover deficits. Thanks to such a classification, indicators of all budgets can be compared. Codes of types of expenses and revenues are systematized in order to have complete information about the formation of income and the implementation of budget spending.

Budget classification

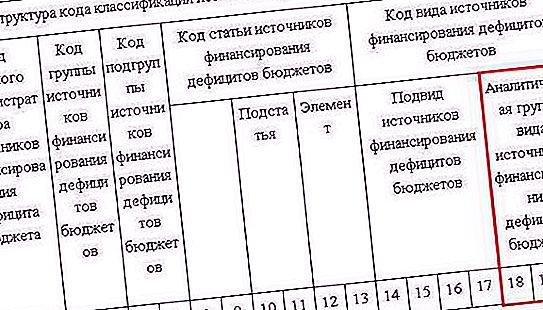

The budget classification of the Russian Federation was adopted through the Federal Law in 1996, and in 2000 it was significantly changed and supplemented. The budget classification provides sections for codes of types of budget revenues, codes of types of budget expenditures, sources of financing deficits, operations of the general government sector. In addition, sources of domestic financing in budget deficits and external financing of the federal budget, types of internal debt of the Russian Federation, its constituent entities and municipalities, as well as types of external debt of the country are indicated. This article will focus on one of the sections that lists codes of types of expenses. Classification of expenses is carried out according to the following features.

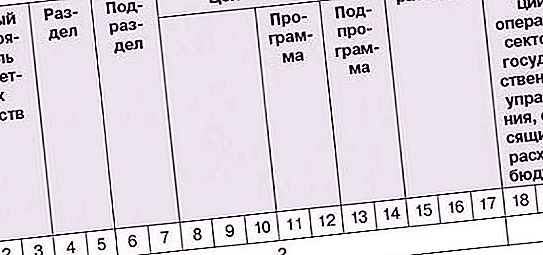

The functional section reflects budget funds aimed at the implementation of the main activities of the state. For example, defense, management and the like. A classification of codes of types of expenses is made in such a way: from a section through subsections to target articles, then types of expenses are opened directly. The type of departmental classification is associated with the management structure, it displays the grouping of legal entities that receive budget funds, that is, they are the main managers of budget funds. The type of economic classification demonstrates the division of government spending into capital and current, it also reflects the composition of labor costs, all material costs and the purchase of services and goods. This is classified according to the following principle: from the category of expenses to groups, then from subject articles to sub-articles.

Functional classification

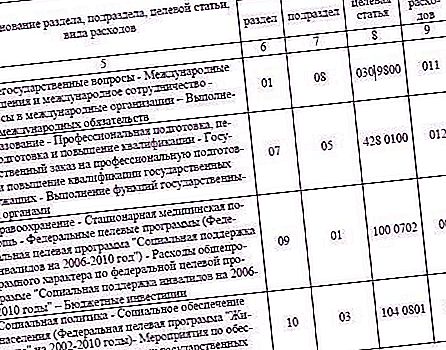

Functional classification is a grouping of budget expenditures at all levels of the system of the Russian Federation, which reflects the expenditure of funds (procurement of goods, defense needs, etc.) to fulfill all the main functions of the state. There are four levels of classification: from sections to subsections, target articles are distinguished from them, then the types of expenses are determined for each. For example, state administration and local self-government pass under the code 0100, and the judiciary under the code 0200. International activities - 0300, national defense - 0400, state security and law enforcement - 0500, promotion of basic research, scientific and technical progress - 0600, industry, construction and energy - 0700, the code 0800 was given to agriculture and fisheries, and 0900 to the protection of natural resources, geodesy, cartography and hydrometeorology.

Next comes transport, communications and informatics, the road sector - 1000. The market and the development of its infrastructure - 1100, housing and communal services - 1200, Ministry of Emergencies - 1300, education - 1400, art, culture and cinema - 1500, media - 1600, health and physical education - 1700 Social code was given the code 1800, public debt - 1900, state reserves and replenishment are held under the code 2000. Budgets of other levels are financed under the code 2100, elimination and disposal of weapons (including under international agreements) - 2200, 2300 - special eco mobilization costs nomics, space - 2400. Under the code 3000 are the so-called other expenses. And the code KOSGU (Classification of operations of the general government sector) 3100 belongs to the target budget funds. Further details take place, which can be seen in the following example. In section 0100 (state administration and local self-government) subsection 0101 is the activity of the head of state (president of the country), target article is 001, which indicates the content of the head of state, type of expenditure is 001, that is, salary (salary of the president of the Russian Federation). In the same way, budgets are built at each level, taking into account specifics and specifics. Functional classification is necessary to determine federal needs where budget investments are directed.

Departmental classification

This grouping of expenses refers to recipients of funds from the budget, and each year this list is reapproved by law, that is, the budgets of each subject of the Federation and each local budget must be approved by the relevant authorities. The KOSGU comparative table includes all state bodies, all extra-budgetary funds, all self-government bodies and municipal institutions that must apply the CWR (expense type codes). Since 2016, autonomous and budgetary institutions have been applying them for sure. The KOSGU code is the main component of the classification of budget expenditures. The structure of such a code: the corresponding group, subgroup and element from 18 to 20 digits. The rules of application and the list of types of expenses are the same in all budgets of the country's system. Code 100 denotes the costs of ensuring the functioning of municipal bodies and governing bodies of extrabudgetary state funds, state institutions. Code 200 - purchase of goods, services. This also includes work for municipal and state needs. Code 300 - social benefits to citizens. Code 400 denotes capital investments in municipal state ownership.

Under the code 500 are inter-budget transfers. Subsidies to autonomous, budgetary and non-profit organizations - code 600. Municipal public debt - code 700, and 800 - other budget investments. Here, the classification is detailed to subgroups (e.g., 340, 110, and so on) and elements (such as 244, 119, 111). For autonomous and budgetary institutions, the list is greatly reduced. Only the following codes are applied: 111, 112, 113 - wages and other payments to workers, 119 - insurance premiums, payment of benefits, 220 and 240 - purchase of goods, services, works (for social security such purchases are held under code 323), and social payments 321 for citizens. Scholarships - 340, grants, bonuses to individuals - code 350, other payments to the population - code 360. Capital investments - 416 and 410, and capital investments in construction - 417. For the execution of judicial acts code 831 is used. Payment of taxes, fees and other charges - code 850. Contribution to an international organization June passes under the code 862, and payments under agreements with international organizations and the governments of other states - 863.

Classification link

The distribution of costs requires mandatory management of the table of correspondence of the codes of the KOGSU and the above codes, and this is done by all state bodies and local self-government, all institutions and extrabudgetary funds. Especially for autonomous and budgetary institutions, the Ministry of Finance has provided an additional clarification table of compliance with KOSGU and CWR. If payment of expenses is carried out according to codes that are inappropriate for departmental detailing, this is considered to be an inappropriate expenditure of budget funds, responsibility for this, including criminal liability, is assumed. The classification linking examples below will help to properly compose such documentation.

Today it is impossible to live without the fixed costs of information and communication technologies to any institution or organization. They are paid differently at the municipal, regional and federal levels, even for autonomous and budgetary institutions there are some features in payment. Recipients of budget investments are different bodies. ICT at the federal level is paid according to code 242 (refers to the procurement of goods, services and works - ICT). At the municipal and regional level, this code is used only with the appropriate decision of the financial authority of a constituent entity of the Russian Federation or a municipal formation. If such a decision has not been made, ICT is paid according to code 244 (other purchases of goods, services and works). In the same way budget expenditures are held in territorial extrabudgetary funds. For autonomous and budgetary institutions, ICT expenses are provided for under code 244, and code 242 is not provided.

Equipment purchase

For example, the situation is this: how to draw up the costs of acquiring GLONASS equipment to equip vehicles, what type of expenses should be applied here? If this is a defense order, then the expense type code will be 219, if not, then one of the elements of type 244 (other purchases of goods, services and works). It is necessary to accurately determine the article, a sub-item of COSGU and then correctly reflect these costs in the accounting statements. Defining an article is not such a simple matter. For example, a car antenna is bought, installation and setup are paid (not a defense order). These expenses are also reflected under code 244, because a car antenna cannot relate to other elements of the form of expenses. This is not code 241, because it is not scientific and not research work and not experienced design. This is not code 243, because this product can not be attributed to the target for the overhaul of municipal property. And this is not code 242, because the antenna is not a means of communication in itself, and its installation is not a service in the field of information technology.

Only code 244 remains, and using it in this case is the only correct output. Or another situation. A new elevator car is installed (not a defense order), and you need to determine the type of expenses for such costs. Installation of the elevator is associated with the replacement of the old cab with a new one (overhaul agreement) or the elevator car is installed initially (change of technical characteristics, contract for reconstruction or construction). In the first case, the costs must be reflected in element 243 (procurement of goods, services, works for the overhaul of municipal property). In the second case, an element with the code 410 (budget investments). Or, for example, a DVR is bought. If this is a defense order, the costs must be reflected by the element of code 219, and if not, then again the desired code is 244 (for the same reasons as the cost of the antenna).

Business trip

In 2016, municipal state institutions, when planning budgets and executing them, should ensure comparability of indicators, that is, conduct an analysis of accrued expenses by their types, and not only by KOSGU codes, the details of which are preserved. Now it needs to be done at the same time using the KOSGU codes and the BP codes. The procedure for assigning travel expenses to the corresponding codes has also changed. What code is used to pay for business trips and services associated with it (ordering tickets, their delivery, hotel reservations, etc.)? These services are provided by a third-party organization on the basis of the contract, and therefore they are reflected according to the BP element with code 244.

If an employee of a municipal state institution goes on a business trip, then everything related to his expenses on the trip goes under code 112 (other payments to staff other than pay). If the business traveler works in any state body (hereinafter referred to as the division into civil and military bodies), then his expenses are spent under code 122 (other payments to the staff of municipal state bodies except for wages). If a soldier is seconded or a person equated to him, there will be code 134 (other payments to personnel with special ranks). And, finally, if the business traveler is an employee of the apparatus of the extra-budgetary state fund, then the code for his expenses is 142 (other payments to staff other than wages).

Travel expenses

Suppose, with a certain citizen, a civil legal contract is concluded for the provision of any services or the performance of work. Question: how to spend these expenses if the compensation of his travel expenses is part of the payment under the contract and if it is paid separately? In the first case, the payment is reflected in the same BP code as the contract. These costs are paid depending on the level of the budget and the type of institution - according to the element of expenses 244 or 242. In the second case (when separate compensation), fare is reflected under element BP 244 (other procurement of goods, services and work for municipal needs).

Next, you need to act in accordance with the elements of the BP group 100 (expenses for paying staff for the functioning of state bodies, governing bodies of extra-budgetary state funds, state institutions), codes 142, 134, 122, 112, which reflect the payment of travel by employees under the report. But in the second case (when a civil legal contract was concluded), it is impossible to apply the elements of BP of group 100 in any case, because labor legislation does not apply to citizens who are not employees of state bodies and institutions. And such expenses do not apply to subgroups 230, 220, 210, to elements 243, 242, 241. Only one code is suitable here - 244.

Hospitality expenses

The expenses associated with the reception of official delegations should be reflected in accordance with element РВ 244 (another purchase of goods, services and works for municipal needs), because this type of expenses cannot be attributed to any other element. It cannot pass under the code 241 as scientific, research or experimental design work, it does not fit under code 243 as the purchase of goods, services and works for the overhaul of municipal property, it is impossible to designate these costs with code 242 as the purchase of goods, services and work in the field ICT

Section III of the guidelines, which were approved by order of the Ministry of Finance of the Russian Federation under number 65H of July 2013, states that all hospitality expenses of each institution should be reflected in accordance with BP 244. All other decisions will be incorrect and may result in charges of misuse of public funds.

Outsourcing

Outsourcing (providing the right personnel under the contract) also involves the cost of paying for services. For example, an institution needed a caretaker, disinfector, or plumber. Reflect the costs of paying for this kind of services according to the contract should be on the element BP 244 (other procurement of goods, services, works for municipal needs).

In the legislation of our state, such a thing as outsourcing does not appear. However, there are private explanations where the specialists of the Ministry of Finance indicate that the conclusion of an outsourcing contract is equal to a contract for the provision of services or the performance of work by contract. The costs of the contract are considered as the costs of the purchase of security services (watchman), disinfection, repair of water supply or sewage systems. Such expenses cannot be attributed to any of the elements of BP, except for the element in code 244. In the same way as in the previous examples, this type of expenses does not fit under code 241, nor under 242, nor under 243.