A shareholder is an individual or legal entity, including a joint-stock company or a foreign company, not having the status of a legal entity, but having civil legal capacity in accordance with the legislation of a foreign state. The shareholder may be the Russian Federation, its constituent entity or municipality, which own one or several shares of the joint stock company’s capital.

Shareholders and Management

A shareholder is a person who, together with other persons having this status within the company, is a representative of the management body of the company. Any decisions within the organization are made at the stockholders meeting, both at the next and extraordinary. The volume of shares determines the rights of shareholders in relation to the company. This can be either the right to nominate a candidate for the board of directors, or the right to put the issue on the agenda of the general meeting. The size of the block of shares in no way affects the right of the shareholder to participate in the meeting and the right to receive dividends. Dividends are calculated in accordance with the size of the block of shares, but only if the decision to pay them was made at a planned meeting.

Investors and Management

An investor can be either a legal entity or an individual who invests its capital in investment projects. The investor is more interested in projects that are able to minimize risks. The participants of the joint-stock company are interested in promoting projects with the aim of increasing dividends by actively participating in their development. An investor does not have such a right. He simply considers the project, analyzing its actual state and prospects, makes a decision.

What are the shareholders?

A shareholder is the owner of certain shares, the type of which determines his membership in a particular category. It can be distinguished:

- owner of ordinary shares;

- owner of preferred shares.

The following categories are distinguished depending on the volume of assets:

- the only shareholder who owns 100% of the shares;

- majority or large, which owns the prevailing package of securities, giving it the right to participate in the management of the joint-stock company;

- minority shareholder, he owns less than 50% of voting shares;

- A retail shareholder is a person who owns a minimum amount of shares, allowing only to participate in the general meeting and giving the right to receive dividends.

If there is only 1% of the shares, an individual or legal entity already has the full right to participate in the selection of candidates for the board of directors of the company. As for the investor, no matter what amount he invests in the project or in the company, he will not receive this right. The maximum similarity between the two participants in the financial market can be seen only if we compare the investor and the retail shareholder. Moreover, the latter will have a certain advantage in terms of the right to participate in the general meeting.

Opportunity difference

If we consider shareholders and investors in terms of possible prospects for earnings, we can talk about the presence of more diverse instruments in the latter. The investor has everything necessary for investing funds not only in the joint-stock company, but also in precious metals, currency, securities, including stocks, but without obtaining the right to participate in decision-making regarding the activities of the company in which he invested. It is worth saying that in case of bankruptcy of the project, the investor does not receive anything. The shareholder has the full right to claim his share in accordance with the block of shares, counting on the capital of the organization, which remains after payment of all debts. This right applies not only to the material base of the enterprise, but also to the property on its balance sheet (equipment, machinery, real estate, etc.).

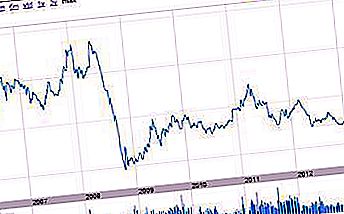

Shareholders and investors - striking similarities in the example of Gazprom shares

Gazprom shareholders and people who decided to invest their money in a large Russian company are essentially the same people, though only if we consider work with small capital. Investments can be very different, including investing in the purchase of shares, which determines the presence of colossal similarities. A meeting of shareholders for shareholders and parallel investors is carried out systematically, but to take part in them or not, this is an individual decision of everyone. Having a minimum share of the rights to own a company, an individual or legal entity cannot influence changes in the rules of its work. Gazprom shareholders (and, in parallel, investors) purchase assets either through a bank, or with the support of a brokerage company, or on the MICEX and RTS exchanges. Small investors and shareholders in most situations do not wait for dividend payments, decisions on the implementation of which are taken at the meeting. They catch the moment the shares rise in price and sell them, earning on the price difference. This trend is relevant only for small shareholders and investors. Major participants in this market segment have larger plans and goals.

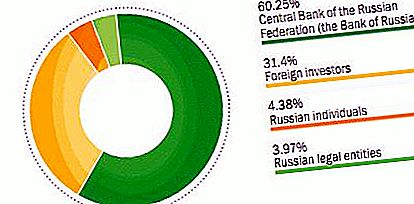

What is the difference between a shareholder and an investor in Sberbank?

As in the situation with Gazprom, there is no difference between small shareholders and investors, since investing in the country's largest financial institution is only possible through the purchase of shares, which automatically transfers a financial market participant from one category to another. Sberbank shareholders holding preferred shares that do not provide access to participate in the meeting can safely be called investors in the full sense of the term. Sberbank shareholders with access to meetings and acquiring assets in order to participate in the work of a financial institution are guided by long-term prospects. After today's global crises of recent decades, modern investors prefer investing in a project with a short payback period of no more than 2-3 months.