The company is created in order to make a profit. Of course, large corporations will argue that "they think of us, " that "we deserve it, " etc. But it all starts with profit. If it exists and is constantly growing, the business is profitable, if on the contrary, the enterprise is considered “burnt out”.

What you need to know to stay in the market? What forecasting and calculation methods should be applied to a beginner? One of the simplest, but no less reliable, is the ability to break even.

Basic concepts of enterprise sustainability

Now it is impossible to open an enterprise without thinking about when it will bring the first profit. The fundamentals of economics, which are taught even to high school students, contain information about business planning. The most important businessman’s skills should be considered not so much an “entrepreneurial vein” as the ability to assess risks, costs and time spent. The indicators of enterprise sustainability include such basic characteristics as:

- breakeven schedule;

- margin of safety;

- leverage to accelerate production.

A bit of history

In the early 30s of the last century, the scale of production increased at a fairly rapid pace. In the face of growing competition, methodologies for assessing entrepreneurship opportunities were needed. It was then that the methodology for assessing the critical volume of production appeared (now known as the company break-even chart). Engineer Walter Rautenshtrauh proposed to correlate the volume of production with the gross costs of the enterprise. However, to optimize the company’s activities, it was necessary to divide the costs into fixed and variable.

Basic concepts

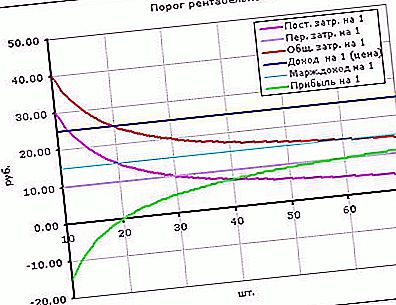

We can say that the success of the enterprise is based on three factors - this is the price of the goods, volume of production, profit. The price of goods sets the market. The volume of production is determined by the capacity of the enterprise, and profit is the cost of production. It sounds somewhat absurd, but the lower the gross costs, the lower the cost, which means that the difference between the market price of the goods and the cost price is greater. This is profit.

The break-even chart just allows you to find the optimal ratio of these characteristics. Microeconomics calls this analysis CVP analysis. The abbreviation is formed by the first letters of the words of the English language: Cost-Volume-Profit. It is important to conduct such an analysis before starting production activities in order to avoid future disappointments.

One of the elements of CVP is the calculation of the volume of production at which the initial investment and operating costs will pay off. In other words, we can say that the analysis of the breakeven schedule allows you to determine when the company will begin to make a profit.

What you need to know to plot

There are two ways to answer the question of obtaining the first profit: determine the time (in six months, for example) or calculate the quantity of products that need to be sold (1000 pieces of goods). In both cases, they talk about calculating the breakeven point. This is a situation in which the sum of all costs of the enterprise, including initial investments, will be equal to the income from units of goods sold at the market price.

How to build a break-even chart? First you need the following data:

- Fixed costs are costs that are independent of the volume of production. The formulas use the abbreviation TFC (total fixed cost). When it comes to new projects, the initial investment is considered a fixed cost.

- Variable costs - this is the manufacturing costs of production. They are denoted by the acronym TVC (total variable cost).

The market price of a unit of production. It is indicated by the Latin letter P (price).

Mandatory Assumptions

In practice, to say that the time of production coincides with the time of sale is possible only in the service sector. It is there that the hairdresser sells his skill in the form of a client’s haircut, the chef prepares the salad only after the visitor has ordered it, etc. Therefore, in order to break even, you need to make a few reservations:

- the moment of production of the goods coincides in time with the moment of its sale;

- consumption rates for the production of a unit of goods, as well as the cost of consumables and raw materials are unchanged for the calculation period;

- retail price also fix;

- determine the dependence of revenue on the volume of output linear function.

How to calculate the breakeven point

Actually, the formula for determining the required output is as follows:

BEPunits = TFC / (P-VC).

If the received amount of manufactured goods is divided by the rate of output per day, we get the time for which the project will pay off. It should be remembered that in a month no more than 22 working days. For the convenience of calculations, they usually take a month of 20 days.

We give a simple calculation example. It is necessary to invest 20 thousand den. units At variable costs of 25 den. units You can set up sales at a price of 50 den. units Simple calculations give a profitability threshold of 800 units of production (BEPunits = 20, 000 / (50-25) = 800 units). Having determined that 5 units of products can be produced per day, we get that it takes 160 working days to start making a profit. It remains only to determine the amount of income necessary to reach the breakeven point. Multiply the calculated output by the retail price (800 * 50) and get 4000 den. units

Break-even chart analytic value

Business planning involves identifying risks that can nullify all business activities. Break-even chart is one of the methods for predicting and analyzing them. To do this, it is necessary to consider the activities of the company within a certain time period.

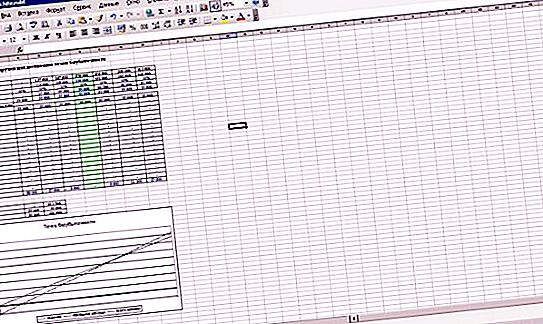

In this case, the fixed costs include not capital costs, but costs independent of output: insurance and credit payments, payment of production facilities (if it is a lease), etc. If the enterprise produces not one type of product, but in the modern world Since it is impossible to survive with such a product portfolio, it is necessary to make calculations for all types of goods. In this case, you need to build a break-even chart in Excel. This will significantly reduce time costs. Having built all the charts on one plane, analysts can determine which product is really successfully sold on the market, and which one is a burden for the enterprise.

For the distribution of fixed costs, the share of each group of goods in the total volume is determined. Fixed costs are allocated according to the proportion.

Margin of financial strength

If a chart is built, the breakeven point is determined. This means that you can calculate the stock of financial strength of the enterprise. It determines how much the company can safely reduce the volume of output. For calculations, use the difference between revenue from sales and break-even point, referred to revenue. The obtained characteristic determines the percentage of output of goods by which production volumes can be reduced.

It should be noted that the obtained strength value is not an accurate characteristic. The fact is that the company’s portfolio contains both “successful” products and “lagging ones”. By reducing the production of "successful" by the maximum possible amount, you can get a negative result of the company.

Production leverage

What else can you find out if you can break even? Cost and revenue data can be used to determine production leverage. This characteristic shows the percentage change in profit with an increase in production by 1%. To calculate, it is necessary to divide the margin between revenue and production costs into the same margin, previously reduced by the amount of fixed costs. This indicator can change over time, so you need to clearly define the time period.

Settlements for trading

How to build a break-even chart for a store that sells many product groups? Even when using the software, the plane with the graphs will be so busy that the analyst will need time to “decrypt” the result. To approximate the break-even point, you can use the following formula:

BEPincome = TFC * (100 / i).

Index i defines the average trade margin.