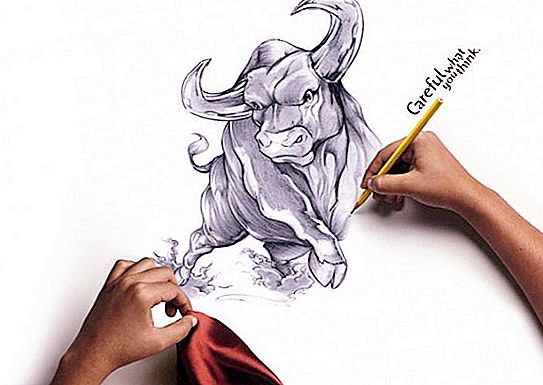

Technical analysis of the stock market allows us to assess the balance of power of the “bulls” and “bears” at the current time. Technical analysis appeared as a result of traders observing a price chart and identifying rules of behavior formed through analysis of market psychology, repeating history and other factors.

Technical analysis is carried out using various indicators. Professional forecasts are made by professional traders after technical analysis.

The Russian securities market is still underdeveloped in comparison with the markets of other countries. The development of the stock market contributes to the expansion of financial instruments. In addition, there are various types of stock markets. The primary stock market involves the issuance and placement of new securities for the first time. The secondary stock market may be organized or unorganized. Stock markets are also classified by territoriality.

Depending on the financial instruments traded, the trader chooses a broker to gain access to the trades. The rating of Forex brokers allows you to assess the number of financial instruments that a particular broker accesses. Brokers have different commissions and working conditions. It is necessary to think carefully when choosing a broker for trading. The rating of Forex brokers includes a comparison of brokers for all important aspects of work.

Differences between fundamental and technical analysis

Fundamental analysis involves the study of fundamental factors that influence the price during the news release and in the long term. Fundamental indicators include: the level of GDP, unemployment, changes in the refinancing rate, etc.

Technical analysis involves the analysis of a price chart using indicators, geometric shapes, support lines and price resistance. Technical analysis more fully takes into account the psychological aspects of players in the short and medium term. Almost all traders use this type of analysis, while few players use fundamental analysis, which is associated with the need to study a large amount of data to form objective conclusions.

Even after drawing conclusions based on a fundamental analysis, the trader is looking for the most convenient entry point into the market using technical analysis tools. Many traders use special programs to conduct technical analysis. The stock market analysis program, as a rule, analyzes the chart and identifies the signals of various indicators. Nevertheless, most traders are engaged in the analysis of charts on their own, without using additional software. Technical analysis of the stock market implies the use of signals from different indicators, while the program gives signals based on one or two indicators and does not take into account many other factors, such as the release of important news, etc.

Postulates of technical analysis

The main functions of the market are as follows:

- in the concentration of free cash through the sale of securities;

- in attracting investments by organizing the purchase of company securities;

- in ensuring their high level of liquidity.

Stock market - the concept is not as abstract as it might seem. Behind securities placed for sale are the real economies of operating organizations that provide jobs, produce goods, work or services, and pay taxes.

There are three main tenets in the stock market that professional traders use to build their trading strategies:

- Price takes everything into account.

- The price is moving directionally.

- History repeats itself.

Price takes everything into account. Like the currency, Forex, the stock market takes into account not only the state of the country's economy, but also the expectations of traders. Expectations are based on rumors, news and fundamental market analysis, as well as insider information. Analyzing the chart, the trader applies his knowledge, information, indicators and other means of analysis to determine the most likely future direction of price movement.

The price can be affected by a huge number of different factors, such as: statements by politicians, natural disasters, the expectation of important news, etc. All, absolutely all publicly available information is already contained in the price.

The price is moving directionally. The stock market, like the Forex market, is prone to trends. That is, the price never moves randomly. This is confirmed by the main indicator of technical analysis - the trend.

History repeats itself. The psychology of most of the players implies the presence of certain scenarios of actions that are activated in different situations. It is the repetition of history that contributes to the allocation of general rules for conducting technical analysis of the market.

Technical Analysis Indicators

Technical analysis of the stock market is carried out by building and using the following indicators:

- trend line, support and resistance levels;

- geometric figures;

- technical indicators of the oscillator group;

- trending technical indicators.

Trend line

If the price moves up or down, this movement can be called a trend. If the price moves sideways, this is a sideways trend. A trend has several cycles: nucleation, development and completion. A trader is looking for signs of an emerging trend to enter the market in his direction. You need to exit the market at the first sign of the end of the trend.

The emergence of a trend in the long run, as a rule, is due to fundamental factors. So, a trend can form under the influence of important news. One of the tenets of exchange trading is: do not play against the trend or play in the direction of the trend. If a trader tries to play against the market, he will ultimately be at a loss.

Trend development can take a long time. Trends can last for months or even years. The completion of the trend is also due to fundamental factors. A sign of its completion may be a large price fluctuation in the opposite direction. This hesitation indicates that a major player has closed the position.

If you look at the chart below, you can see a downtrend. The trend line with a downtrend is drawn at price highs. In a downtrend, its line is drawn at price lows.

To determine the trend, traders also use additional indicators, for example, moving averages, ADX and others.

Support and Resistance Levels

The resistance level is the line that the price touched several times and fought back. For example, a trend line (in the example above) serves as a resistance line. The image shows that the price touches the trend line, but does not break it. Near the trend line, it is necessary to enter the market in the direction of the trend, provided there are no signs of its completion.

After the price breaks through the resistance line, this line becomes the level of price support. This is demonstrated in the price chart below.

Geometric figures

The following figures are distinguished, used for technical analysis of the chart: triangle, rectangle, “flag” (“pennant”), “head and shoulders”, “triple top”, “double and triple bottom”, “saucer” and others.

All figures are divided into two groups: reversal and continuation figures. Pivot patterns show the trader the possibility of a reversal of the current trend, and continuation patterns - indicate its most likely further continuation. Most often, the method of geometric shapes is not used on its own, but in conjunction with other means of analysis.

Technical analysis of the stock market, like the Forex market, involves the use of geometric shapes, which is due to the repetitive behavior of most traders if they occur on the chart. In both the stock market and the foreign exchange market, this technique of analysis is widespread.

Triangle. There are four types of triangles that are used to predict price behavior: descending, ascending, symmetrical and expanding triangles. This figure belongs to the reversal group. Before entering the market when forming this figure on the price chart, it is necessary to wait for the breakdown of its borders.

Rectangle. This figure is formed when clear horizontal lines of support and resistance appear on the chart. The rectangle indicates the balance of power in the market.

“Flag” or “pennant”. These are trend continuation patterns. The appearance of a flag or pennant on the price chart is accompanied by a correction of the trend movement.

"Head and shoulders". This figure is of great importance in education on the daily chart. In smaller timeframes, a small number of traders work, which means a reaction to the formation of a figure below. The figure belongs to the reversal group. Also, in the technical analysis, the “inverted head and shoulders” figure is often used, which in this case is called the “double bottom”.

Triple top. This figure belongs to the reversal group and forms three peaks at the same price level.

"Double and triple bottom." This model is the opposite of the triple top. The price outlines three lows in one range.

"Saucer". Reversal trend model. Of greatest importance is the long timeframes - daily, weekly chart. The formation of this figure can last more than a month.

Trend Technical Indicators

Determining the direction of a trend plays a decisive role in trading. The game against the market rarely ends in profit. Technical analysis of the stock market is very similar to currency analysis.

Moving Average. Moving averages or MAs are the most important trend indicator. This indicator visually represents a line that is built at average prices for a specified period. When building this indicator, closing prices are the most important.

There is a saying in the investment market: "The market is opened by amateurs, and professionals close." It fully reflects the importance of closing prices. Professional traders open deals in large amounts and have a strong influence on the price. It is for these reasons that closing prices are given the greatest importance.

The most popular varieties of MA are simple, exponential and weighted moving average. Simple Moving Average (SMA) is based on the arithmetic average of a selected period of time. Weighted Moving Average (WMA) is built taking into account the coefficient of "weight", that is, the latest prices are taken into account most fully. Exponential Moving Average (EMA) is similar to WMA, but takes into account all prices of the previous period.

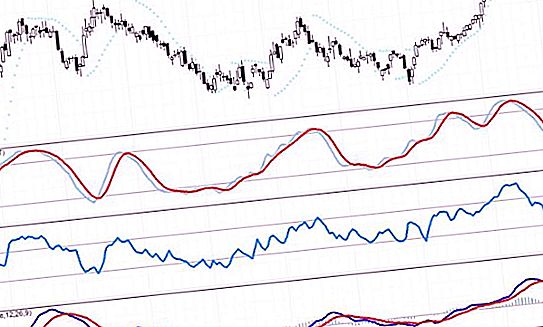

Typically, traders use two MAs of different periods. In this case, a buy signal is considered the intersection of fast MA slow MA from the bottom up. A sell signal is the intersection of fast MA slow MA from top to bottom.

Oscillator group indicators

Oscillators measure market volume. This group of indicators identifies overbought and oversold zones in which a reversal is most likely. The indicators of this group give the most clear signals during the trend movement of prices within the channel.

The most popular oscillators among traders are the following: MACD, Stochastics Oscillator, RSI and others. These indicators are used in the technical analysis of not only the stock, but also the foreign exchange market.

MACD indicator. This indicator is built on the basis of data of moving averages of different periods and is intended to determine the price reversal. It stands for “MovingAverageConvergence / Divergence”, which translates as “Moving Average Convergence / Divergence”.

The formula for calculating this indicator is as follows: MACD = Fast EMA - Slow EMA.

The properties of this oscillator include the fields “fast” and “slow”, which correspond to the period of fast and slow EMA.

When the price is above the zero mark of this indicator and rises, this indicates an upward movement of the price, and vice versa, if the price is below the zero mark and falls, this indicates a downward movement.

The signal of this indicator is the intersection of the price at the zero level. So, crossing the zero mark from the bottom up is a signal to buy, and from top to bottom - a signal to sell.

If the indicator shows a false price movement (divergence), then this serves as a signal for a price reversal.

Stochastics Oscillator indicator. Stochastics (Stochastic) takes into account not only closing prices, but also local highs and lows. This indicator is more informative than other indicators of the oscillator group. This indicator provides for an overbought zone, which is located above the level of "80", and an oversold zone, which is located below the level of "20".

The signal to enter the market is the intersection of two lines, similar to the signals of the MACD indicator. Divergence on this oscillator also serves as a strong signal for entering the market.

RSI indicator. The main parameter of this indicator is the period for which it is built. The author’s recommended value is 14, but periods 9 and 12 are also often used. This indicator is used to measure trend strength. It compares the rate of rise and fall of a price over a selected period of time.

If the indicator line is directed upwards, this indicates a prevailing growing trend in the market, and vice versa. Conventionally, the balance of forces, that is, the equilibrium in the market, is reached at around 50. The line crossing the level indicator 50 from top to bottom serves as a signal to open a short sell position. The intersection of level 50 from the bottom up is a buy signal.